Every Thursday during the month of February, I’m posting budgeting tips for you and your spouse or significant other. Last week, I shared tips for setting and achieving financial goals. This week’s tips are devoted to helping you to get out of debt.

First, let’s talk about the biggest thing that has helped us not fight about money during our marriage: Getting out of consumer debt. We still have a mortgage, but eliminating credit card debt and car loans has made a world of difference. No matter your financial state, working towards being debt-free is definitely a goal worth striving for.

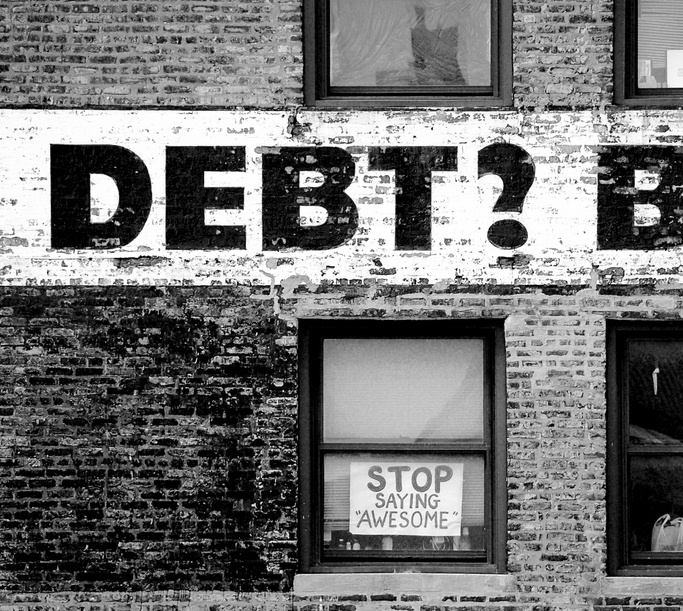

Photo by: Dan Simpson

But what if you are barely making ends meet? How do you work on eliminating debt or building some savings if you can barely pay your bills each month? Well, there is lots of advice out there on how to reduce your spending in different areas, but what it came down to for us was the reality that we needed to make more money. As a result, after 7 years of marriage, I couldn’t even begin to name the number of side jobs we’ve taken on. At one point, I think I was working at least 6 of them at once. Crystal, of Money Saving Mom, has lots of great ideas for earning income on the side. I think I’ve personally done at least 5 things on that list, and all of them helped add to our income at various levels. You can try as many ideas as you have the time and energy for, and I promise you can find something that will work for you.

Next week will be our last week of this series, and I’ll share some final tips for alleviating budget weariness. In the meantime, I’d love to hear from you in the comments with your thoughts on ways to eliminate debt.